Personal Finance App Development: A Must-have Checklist

In the fast-paced digital world, personal finance app development is a promising business avenue for entrepreneurs. Understanding the importance of personal finance and financial management software is the first step toward creating a successful app. It’s about helping users to track their income, and expenses, and align their financial goals with their spending habits. Developing the best app for personal finance management could position your business as a round-the-clock financial advisor, offering users an easy and informed way to handle their finances. Imagine providing your customers with all the advanced features the best online finance manager, right at their fingertips.

In this step by step guide, we will learn about these personal financial apps, how to build a personal finance management app, the must have features, importance of adding more customer centric features, tech stack, core development cycle and best personal finance applications development company.

Table Of Contents

- The Surge in Popularity of Personal Finance Apps

- What is Personal Finance App Development?

- Ideation and Market Research

- Key Features of a Successful Personal Finance Management Apps

- 1. Account Integration

- 2. Security Measures

- 3. Biometric Access & Multi-Factor Authentication

- 4. Real-Time Alerts

- 5. AI Algorithms & Chatbots for Useful Advice

- 6. Real-Time Spending and Tracking

- 7. Simplicity & User Experience

- 8. Constant Customer Support

- 9. Alerts and Notifications

- 10. Financial Advice and Consultation

- Categories of Personal Finance App Development

- Most Common Personal Finance Apps

- How to Build a Personal Finance App: Step-by-Step Process

- Personal Finance App Development Cost and Timeline: Factors Influencing the Budget

- Top Personal Finance Apps and Their Features

- Personal Finance App into a Gold Mine: Monetization Strategies

- Personal Finance Management Apps: Tips for Success

- APPWRK IT Solutions – Build the Ultimate Personal Finance App with us!

- Conclusion: The Future of Personal Finance App Development

- FAQs

The Surge in Popularity of Personal Finance Apps

The rising popularity of personal finance or money management apps presents a lucrative opportunity for entrepreneurs. As more people manage personal finances online, businesses that provide an efficient, user-friendly online finance management system can gain a competitive edge. From being a personal budget planner to a comprehensive financial guide, these apps are now essential tools for many.

Whether you’re developing the best Android app for household and personal budget and finance management, or an iOS counterpart, the opportunities are plentiful. Personal finance management apps are no longer just a trend, but a necessary tool for many, opening up a substantial market for businesses.

What is Personal Finance App Development?

Personal finance app development is about creating an application that assists users in managing their finances effectively. As an entrepreneur, you’d essentially be creating a full money management app or program that users can access with ease. This process involves understanding user needs, planning functionality, and harnessing the latest technology to offer an intuitive and secure app.

Building a personal finance app involves finding answers to key questions like ‘How to build a personal finance app?’ and ‘What is the personal finance app development cost?‘ As a finance app builder, your focus should be on designing user-friendly interfaces, integrating robust security features, and offering comprehensive financial management tools. The ultimate goal is to drive your best personal finance app mobile app development project towards creating a product that is user-friendly, secure, efficient, and, above all, valuable to your potential customers. Let’s dive into this comprehensive guide and know everything about personal finance app development.

Ideation and Market Research

The journey toward creating a successful personal finance app begins with ideation and market research. It’s like setting the foundation for a building; the stronger it is, the more resilient the structure.

A. Defining Your App’s Purpose and Target Audience

Every great invention starts with identifying a need, and a smart personal finance app, is no exception. The first step in this journey is defining your app’s purpose. Are you aiming to create a budget planner, a finance tracker, or an all-in-one personal finance management tool? 🎯 Identifying your app’s purpose is key to shaping its features and functionality.

Equally important is defining your target audience. Are you targeting millennials who need a guide to manage their first paychecks, or retirees looking for an efficient way to manage their savings? The best app for personal finance management should be tailored to the needs and preferences of its users. Remember, an app is only as successful as its user engagement.

B. Market Trends

Once you’ve defined your app’s purpose and identified your target audience, it’s time to take a deep dive into market research.

According to the NMSC report:

- The Global Personal Finance Software market size was valued at USD 0.94 billion in 2019 and it is predicted to reach USD 1.80 billion by 2030.

- It is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2020 to 2030.

Key Features of a Successful Personal Finance Management Apps

Navigating the financial seascape can be daunting, but a well-crafted personal finance management app can serve as a trusty compass, guiding users toward financial well-being. However, not all compasses are created equal. Here are the key features that can set your app apart, helping users steer their financial ship effectively.

1. Account Integration

The starting point of any personal finance app is account integration. This allows users to link various financial accounts, including bank accounts, credit cards, and investments, providing a consolidated view of their finances. It’s akin to having a financial dashboard at your fingertips.

2. Security Measures

Financial data is sensitive, and its security is paramount. Employ robust security measures like data encryption, two factor authentication and secure coding practices to create an impenetrable fortress around user data. It’s like having a personal guard for your financial information.

3. Biometric Access & Multi-Factor Authentication

A double layer of protection – biometric access and two-factor authentication – adds an extra layer of security, keeping unauthorized users at bay. It’s like having a high-tech lock on your financial safe.

4. Real-Time Alerts

Real-time alerts notify users about important financial events, such as bill due dates or large transactions. It’s like having a personal financial assistant, keeping you informed and alert.

5. AI Algorithms & Chatbots for Useful Advice

Artificial Intelligence (AI) is reshaping the finance landscape. AI algorithms provide personalized financial advice, while chatbots offer useful tips and answer queries. It’s like having a financial guru and an always-available helpdesk rolled into one.

6. Real-Time Spending and Tracking

This feature enables users to track their spending in real time, helping them stay within budget and avoid overspending. It’s like having a real-time financial health monitor.

7. Simplicity & User Experience

An intuitive and user-friendly interface can greatly enhance the user experience. Keeping things simple and easy to navigate is like providing a smooth sailing experience in the financial sea.

8. Constant Customer Support

Users may need assistance or have queries, so offering 24/7 customer support is crucial. It’s akin to having a friendly guide ready to help at any time.

9. Alerts and Notifications

Timely alerts and notifications about account activities, market updates, and financial tips keep users informed and engaged. It’s like having a personal finance news reporter.

10. Financial Advice and Consultation

Including a feature for financial advice or consultation adds value for users, helping them make informed financial decisions. It’s like offering a financial planning session within the app.

Categories of Personal Finance App Development

Personal finance apps are revolutionizing the way we manage our money, offering a range of services from simple tracking of income and expenses to complex features that allow real-time synchronization with bank accounts. These apps can be broadly divided into two categories – basic finance apps and advanced finance apps.

1. Basic Personal Finance Apps:

Basic personal finance apps, as the name suggests, are straightforward applications that provide simple tracking of income and expenses. The user manually enters their financial information into these apps.

Advantages:

- These apps pose virtually no risk as they don’t connect to bank accounts directly.

- They are cost-effective to develop due to their simplicity.

Disadvantages:

- The risk of human error is relatively high due to the manual data entry process.

- The process of entering and tracking data can be time-consuming.

2. Advanced Personal Finance Apps:

On the other end of the spectrum, advanced personal finance apps offer a more comprehensive set of features. These various banking apps allow users to link their bank accounts and cards, enabling automated data synchronization.

Advantages:

- Advanced apps offer a wide range of features, enhancing the overall user experience.

- They save users time by automating data entry and providing real-time transaction updates.

- Users get a more accurate picture of their financial status due to real-time updates.

Disadvantages:

- Security is a significant concern since these apps handle sensitive data. This requires additional investment in robust security measures during app development.

- The cost of developing advanced personal finance apps is higher due to the integration of complex features.

Most Common Personal Finance Apps

There are different types of Personal Finance Apps that serve a unique purpose, catering to different financial needs. Whether you’re a budget planner, an investing enthusiast, or someone striving to save more, the following are some major types popular personal finance apps for you:

1. Budgeting Apps

Budgeting apps are the new-age money managers. They help users create and stick to a budget, track their expenses, and save for their financial goals. It’s like having a personal financial advisor in your pocket, guiding you toward better money management. These money management apps often feature alerts for when you’re close to exceeding your budget, giving you a nudge to stay on track.

2. Expense Tracking Apps

Expense tracking apps are the magnifying glasses of personal finance. They let you delve into the details of your spending, categorizing each expense to give you a clear picture of where your money goes. With these apps, you can track everything from your daily coffee runs to your monthly utility bills. It’s like having a financial diary, one that keeps a meticulous record of your spending.

3. Investment Apps

Investment apps bring the stock market to your fingertips. They allow you to buy and sell stocks, track your portfolio, and even get expert advice. For those who believe in growing their wealth, these apps are the perfect tools. They’re like mini stock exchanges, right in your pocket.

4. Debt Management Apps

Debt management apps are the lighthouses for those navigating the seas of debt. They help users keep track of their debts, plan repayments and even offer strategies to pay off debt faster. It’s like having a personal debt counselor, guiding you towards a debt-free life.

5. Savings Apps

Savings apps are the piggy banks of the digital age. They help users set and track savings goals, making saving money fun and interactive. These apps often employ strategies like rounding up your purchases and saving the change, making saving feel less like a chore and more like a game.

6. Financial Planning Apps

Financial planning apps are the GPS for your financial journey. They provide a holistic view of your finances, help you plan for the future, and even offer personalized advice. It’s like having a financial road map, guiding you towards your financial goals.

How to Build a Personal Finance App: Step-by-Step Process

Creating a personal finance app is a journey, one that involves careful planning, execution, and a whole lot of dedication. Here’s a step-by-step guide to help you navigate this journey and build an app that’s both valuable and user-friendly.

1. Defining the App’s Purpose and Target Audience

The first step in this journey is defining the purpose of your financial app. Are you building a budget planner, a comprehensive finance manager, or something in between? Having a clear vision of what your app aims to achieve is the key to creating something truly useful. As the proverb says, “If you don’t know where you are going, every road will get you nowhere.”

Similarly, knowing your target audience is vital. Tailoring your app to the needs and preferences of your target audience can significantly enhance its appeal.

2. Selecting the Right Technology Stack

The technology stack you choose for your app can significantly influence its performance and scalability. Whether it’s choosing the right programming language, database, or third-party services, each decision plays a crucial role in how your app functions. It’s like choosing the right ingredients for a recipe – each one contributes to the final dish.

Your tech stack depends on factors like target audience, application goals, industry-specific requirements, and third-party integrations.

Consider this tech stack for your financial apps:

Mobile PlatformsiOS and AndroidProgramming LanguagesSwift, Kotlin, and JavaScript FrontendReact Native, Flutter BackendNode.js, Django, Ruby on Rails DatabaseMySQL, MongoDB, PostgreSQL Cloud EnvironmentAWS, Google Cloud, AzureReal-time AnalyticsGoogle Analytics, Firebase Analytics

3. Designing an Intuitive User Interface

A user-friendly and intuitive design is the cornerstone of any successful app. Ensure your app is visually appealing, easy to navigate, and responsive. A well-designed user interface can make financial management a breeze for your users, improving their overall experience. After all, as they say, “Good design is good business.”

4. Integrating Essential Features and Functionalities

Adding essential features and functionalities is what makes your app truly valuable to your users. From expense tracking and budgeting tools to bill reminders and investment tracking, each feature adds a layer of utility to your app. It’s like building a multi-tool – the more useful features it has, the better.

5. Testing and Launching the App

Before launching, it’s crucial to thoroughly test your app for any bugs or glitches. This ensures that your users have a seamless experience from the get-go. Think of it like a final quality check before a product hits the market.

Once you’ve ironed out any issues, it’s time to launch your app. But remember, launching your app is just the beginning. Regular updates, new features, and prompt customer service can keep your app relevant and beloved by your users.

Personal Finance App Development Cost and Timeline: Factors Influencing the Budget

The journey of personal budgeting app is exciting, but it also comes with its fair share of considerations. One of the key aspects to consider is the cost and timeline of development. Several factors influence these, and understanding them can help you plan your budget better. Let’s delve into the specifics.

1. App Complexity

The complexity of your app is a major factor that influences both the cost and timeline of development. An app with basic features like expense tracking or budgeting will take less time and money to develop compared to a comprehensive app with features like investment tracking, bill reminders, and financial planning tools. It’s like building a house – the bigger and more complex it is, the more it costs and the longer it takes to build.

2. Platform Choice

Whether you want to build your app for iOS, Android, or both platforms also impacts your budget and timeline. Building such an app, for both platforms simultaneously requires more resources and hence, increases the cost and timeline.

3. Design Complexity

The design of your app, from the user interface to the logo and icons, also plays a role in determining the cost and timeline. A simple design with basic elements will cost less and take less time to create than a complex design with custom graphics and animations. As the saying goes, “Simplicity is the ultimate sophistication,” but it also comes with its own cost and timeline.

4. Development Team

The cost of your development team is another factor to consider. Depending on whether you hire a freelancer, an in-house team, or an agency, the cost can vary significantly. Similarly, the expertise and efficiency of your team can influence the timeline of development. It’s like hiring a crew for a ship – the size, skills, and efficiency of the crew affect the journey’s cost and duration.

5. Maintenance and Updates

Post-launch, your app will require maintenance and updates, which add to the overall cost. Regular updates, bug fixes, and new features keep your budgeting app fresh and relevant, but they also require time and money. It’s like maintaining a car – regular servicing ensures a smooth ride but comes with its own costs.

Based on the factors mentioned above, personal finance app development may cost you between $10,000 – $50,000. However, this is just a rough figure – which may vary according to your requirements. Therefore, you can contact a mobile app development company for further assistance.

Top Personal Finance Apps and Their Features

As we navigate the financial seascape, we often seek reliable tools to guide us. Personal finance and budget management apps play a significant role in this journey. Let’s explore some of the leading apps that are making waves in the realm of personal finance and money management apps.

Mint:

Mint (Android or iOS) stands out for its comprehensive approach to personal finance management. It allows users to integrate multiple accounts, track spending, create budgets, and even check their credit scores. Mint’s real-time alerts and custom tips offer a personalized touch, much like having a financial advisor in your pocket.

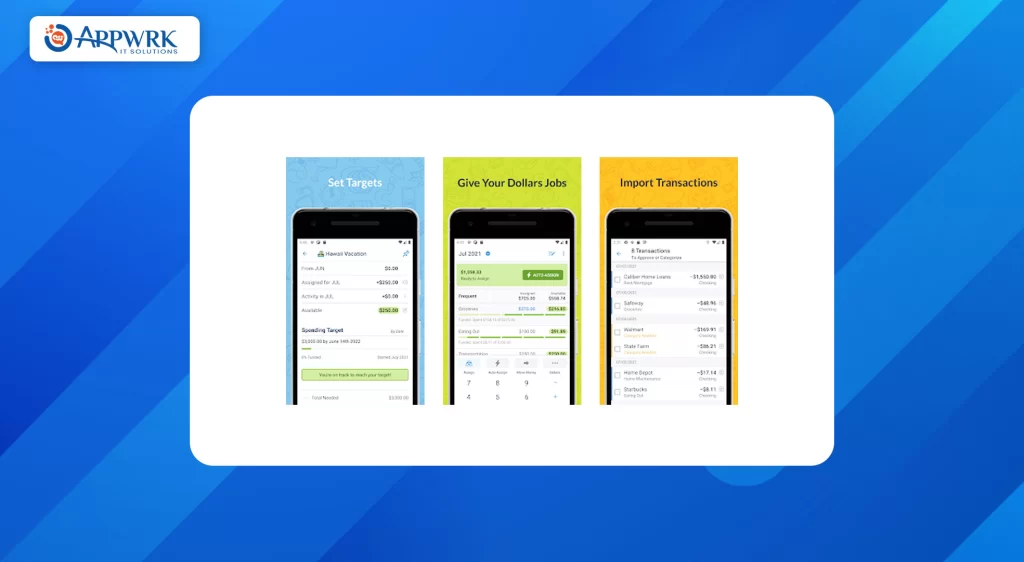

You Need a Budget:

You Need a Budget (YNAB) (Android or iOS) takes budgeting to the next level. With its proactive approach to budgeting, YNAB encourages users to “give every dollar a job,” making it a great tool for those looking to gain control over their spending. It’s like having a personal budget coach on call.

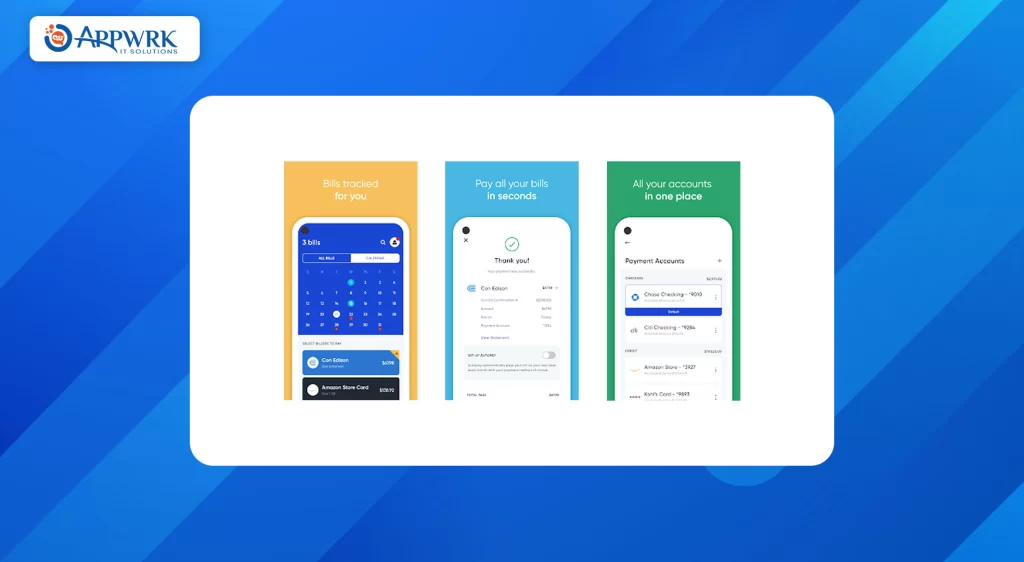

Prism:

Prism (Android or iOS) shines in its ability to manage and track bills. It provides reminders for upcoming bills and even lets users pay directly from the app. It’s like having a personal bill organizer that ensures you never miss a payment.

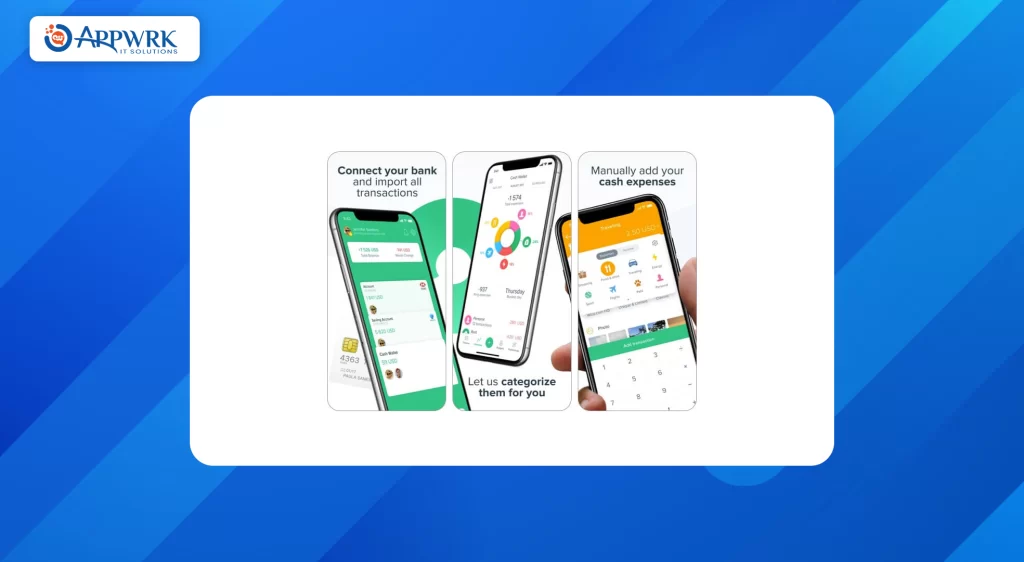

Spendee:

Spendee (Android or iOS) budgeting app provides an eye-catching visual overview of your finances. It tracks income and expenses, allowing users to understand their spending habits better. It’s akin to having a financial mirror, reflecting your spending patterns.

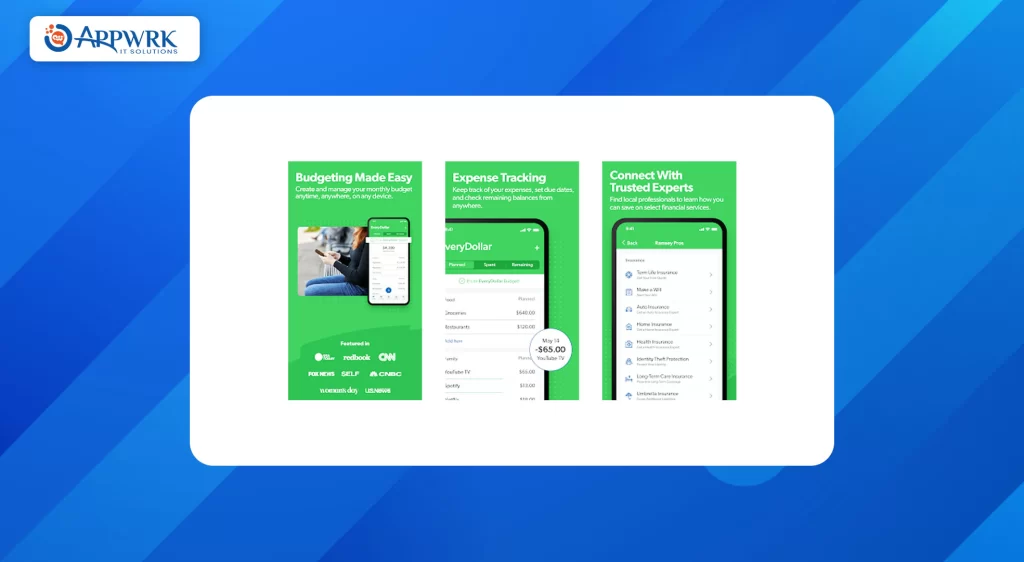

EveryDollar:

EveryDollar (Android or iOS), a budget management app created by financial guru Dave Ramsey, uses the zero-based budgeting method. It encourages users to plan for every dollar they earn, promoting a more mindful approach to spending. It’s like having a masterclass in budgeting at your fingertips.

Mobills:

Mobills (Android or iOS) offers robust expense tracking and budgeting tools. It categorizes expenses, provides insightful charts, and sends timely reminders about due bills. It’s like having a personal expense manager that keeps your financial life organized.

Personal Finance App into a Gold Mine: Monetization Strategies

A successful personal finance app doesn’t just help its users manage their money—it also turns a tidy profit for its developers. Here’s how to effectively monetize a personal finance app:

1. In-App Purchases: Buy a Bit More

In-app purchases allow users to buy additional features or services directly from the app. For example, you could offer premium financial advice, advanced budgeting tools, or custom financial reports.

2. Subscription Model: Pay for the Privilege

A subscription model ensures a steady stream of income. Users pay a regular fee to access your app’s services. It’s like running a club where members gladly pay for the exclusive benefits.

3. Ads and Sponsored Content: Get Paid for Eyeballs

Ads and sponsored content can generate substantial revenue, especially if your app has a large user base. Just ensure the ads are relevant and don’t disrupt the user experience.

4. Partnerships and Affiliates: Earn by Association

Partnerships with financial institutions or affiliate marketing can be lucrative. For example, if a user signs up for a credit card or invests in a mutual fund through your app, you get a commission.

5. Selling Financial Products: Direct Sales, Direct Profits 📈

Your app could also directly sell financial products like insurance, loans, or investment funds. It’s like having a shop where users can buy products that help them achieve their financial goals.

Personal Finance Management Apps: Tips for Success

Creating a successful finance app is much like crafting a piece of fine art. It requires precision, creativity, and an understanding of the audience’s needs. Here are some key tips to consider when developing your finance app. Let’s map out the route to success! 🚀

1. Staying Up-To-Date with Industry Trends and User Preferences

In the rapidly evolving world of finance apps, keeping up with industry trends and user preferences is crucial. It’s like surfing – you need to catch the right wave at the right time. Stay updated with the latest technologies, design trends, and user behaviors. Your app should be a reflection of the current market landscape, offering features and functionalities that users desire. Remember, the key to staying relevant is adaptation.

2. Ensuring Seamless Integration with Other Financial Tools and Services

Your finance app should play well with others. By this, we mean it should integrate seamlessly with other financial tools and services. It’s like fitting pieces of a puzzle together – they should click without any friction. This could include integration with banks, payment gateways, or other finance apps. Seamless integration not only enhances user experience but also increases the utility of your app. It’s all about creating a cohesive financial ecosystem for your users.

3. Continuously Improving the App Based on User Feedback and Analytics

Continuous improvement is the secret sauce to the success of any app. Treat user feedback and analytics as your guiding light. They provide valuable insights into what’s working and what’s not. It’s like having a compass – it points you in the right direction. Use this information to refine your app, fix bugs, and add new features. Remember, the path to perfection is a journey of constant improvement. users engaged

APPWRK IT Solutions – Build the Ultimate Personal Finance App with us!

Stepping into the realm of personal finance application development can indeed be a complex journey. But, with the correct strategy, expert advice, and a trusted partner like APPWRK, your business can launch a successful personal finance app market that not only pleases users but also fuels business growth.

Having executed over 2000+ international projects in just three years, APPWRK stands as a testament to the power of dedication, proficiency, and delivering top-notch mobile solutions. We utilize cutting-edge mobile app development tools and development process to ensure your app aligns with world-class standards.

So, if you’re ready to dive into the dynamic world of mobile app development and embark on an exciting journey from ideation to the creation of a trending app, partnering with APPWRK could be the game-changer for your business.

Conclusion: The Future of Personal Finance App Development

The future of personal finance app development is bright and full of promise. We’re living in an era where technology is transforming traditional finance management, making it more accessible, efficient, and user-friendly. Just as the telescope revolutionized astronomy, innovations like artificial intelligence, blockchain, and big data are set to revolutionize personal finance apps.

Artificial Intelligence (AI) and Machine Learning (ML) are empowering apps with predictive analytics, offering personalized financial advice to users. It’s like having a personal financial advisor in your pocket, guiding you toward financial wellness.

The future of financial literacy is not something that just happens, it’s something we create. As we embrace these innovations and technologies, we’re not just building better finance apps; we’re shaping the future of personal finance and money management process. So, start your journey with APPWRK IT Solutions to invent, innovate, and create a future where managing finances is not a chore, but a delight. Get in touch with us and let us assist you with personal finance app development, where everything leads to prosperity and financial stability!

FAQs

What are the key features to include in a personal finance app?

Some of the essential features to include in a personal finance app are expense tracking, budget creation, financial goal setting, bill reminders, investment tracking, and account synchronization. Depending on your target audience and app’s purpose, you may also consider adding features like financial advice, credit score monitoring, or integration with other financial tools and services.

How much does it cost to develop a personal finance app?

The cost of developing a personal finance app depends on factors such as app complexity, app features used, design, platform (Android or iOS), and the development team’s location and experience. On average, a simple personal finance app could cost anywhere from $10,000 – $50,000, while a more complex app with more advanced features, might cost $100,000 or more. To get a precise estimate, it’s best to consult with an app development company.

What is the typical timeline for personal finance app development?

The development timeline for a personal finance app varies depending on the project’s complexity, features, and the development team’s expertise. Generally, it can take anywhere from 3 to 6 months to develop a simple app, while more complex financial apps, may take 9 months or longer. Keep in mind that ongoing updates, improvements, and maintenance are also essential for the app’s success.

How can I ensure the security of my personal finance app?

Security is a top priority for personal finance apps, as they handle sensitive financial data. To ensure your app’s security, consider implementing measures such as data encryption, secure user authentication, regular security audits, and compliance with industry standards. Additionally, using secure frameworks and adhering to best coding practices will help safeguard your app against potential threats.

About The Author