A Complete Guide About Fintech App Development: Features, Cost, And Much More.

With the disruption of the traditional financial sector, there has been a significant transformation driven by the advent of financial technology, popularly known as fintech, in the last decade. Today, tech-savvy users have changed their preferences and are moving towards digital ways to manage their finances, from budgeting and lending to retail banking and cash management. This technological drift has led to an increased demand for fintech apps in the market.

In today’s business landscape, fintech app development has taken an immense place in the heart and soul of entrepreneurs. Fintech application development has offered businesses the opportunity to modernize their operations, reach customers more effectively, and deliver tailored services.

Fintech apps enable businesses to understand their customers better through data analytics, leading to personalized offerings and enhanced customer experiences. Furthermore, these apps can drive operational efficiency, reducing costs and improving the bottom line. In essence, the rise of fintech apps signals a new age of digital transformation, and businesses embracing them stand to gain a competitive edge.

So, in an era of increased mobile usage and digital-first preferences, let’s build an app and tap into vast market potential. In this guide, we will take you through the various aspects of fintech app development that include the meaning, top fintech apps in 2023, types, trends, cost to develop a fintech app, and much more!

Table of contents

- What Is A Fintech App?

- Fintech Market

- Various Types Of Fintech Apps To Choose From

- Reasons To Develop A Fintech App

- How Do Fintech Applications Make Money Online

- Top Fintech App Development Trends In 2023

- Features To Include In Your Finance App

- Key FinTech App Development Requirements

- Various Stages In Fintech Application Development

- Technology Stack Used In A Fintech Application

- How Much Does It Cost To Build A Fintech App

- APPWRK IT Solutions – Multiply Your Profits With Our Robust Fintech Development Services

- Conclusion

- FAQs

What Is A Fintech App?

A fintech app, short for “financial technology application”, is a digital tool that automates and enhances the delivery and use of financial services. Fintech apps are designed to streamline various financial processes and make them more accessible to the general public. These apps leverage a range of technologies, including artificial intelligence, blockchain, and data analytics, to provide services that are typically more user-friendly, efficient, and transparent than traditional financial methods.

Fintech apps span numerous sectors of the financial industry, including personal finance, investment, insurance, lending, and more. The main aim of fintech apps is to make finance more accessible, efficient, and user-friendly, changing the way people interact with financial services and institutions. For instance, a personal finance app might help users manage their expenses, track their spending, and plan for future savings. An investment app could allow users to buy and sell stocks, while a lending app might facilitate peer-to-peer loans.

Fintech Market

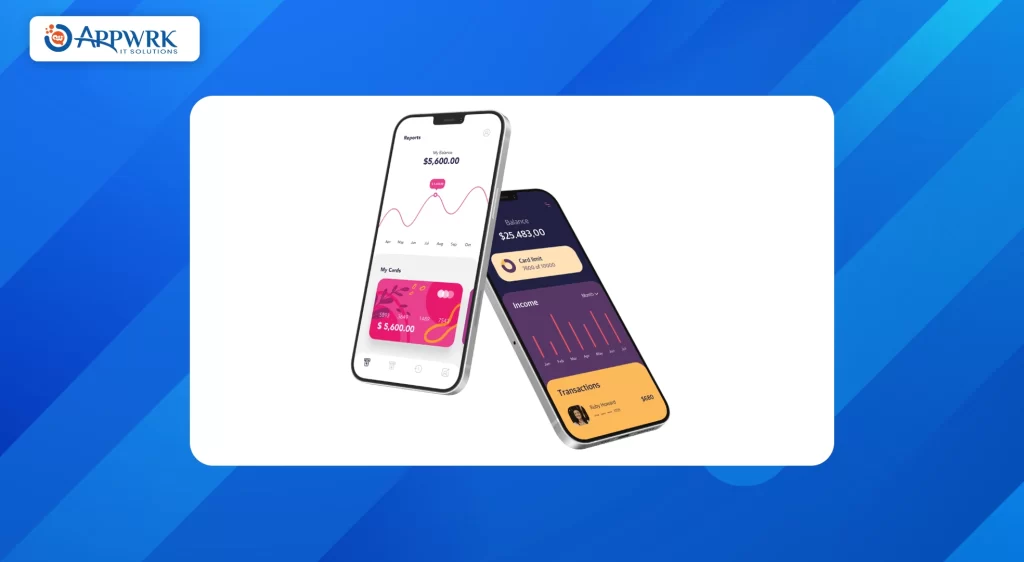

Do you know the global fintech market will be worth approximately $165.17 billion in 2023, according to the latest data provided?

Other than this, the fintech industry is projected to grow to $324 billion at a compound annual growth rate (CAGR) of 25.18% by 2026. Isn’t it amazing!

From the above data, it must be clear that the fintech app market is on the rise, and grabbing this business opportunity will help you in hitting the jackpot. So, let us start by taking a look at the best fintech apps in 2023.

MoneyLion

MoneyLion (Android, iOS) is a personal finance platform offering a suite of products that help users save, invest, and manage their money. It’s an all-in-one platform where users can monitor their credit, get personalized financial advice, access quick loans, and invest in portfolios tailored to their risk tolerance and financial goals. MoneyLion’s vision is to create a more inclusive financial system by providing traditionally underserved consumers with better tools to achieve their financial goals.

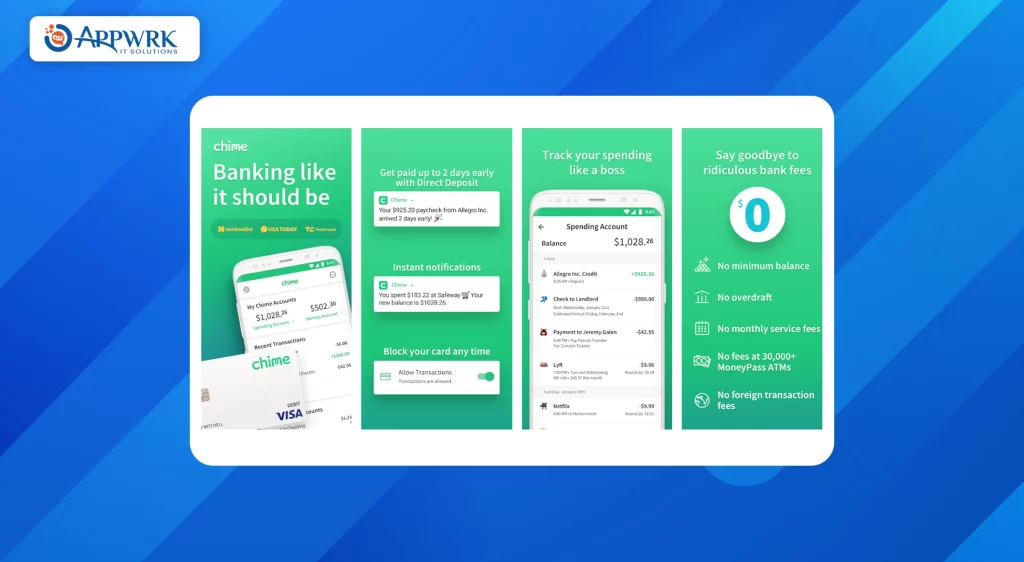

Chime

Chime (Android, iOS) is a digital banking app that offers fee-free financial services through its mobile banking app. Its services include spending accounts, savings accounts, and a credit builder visa credit card, all of which can be managed entirely online. Chime aims to help its members lead healthier financial lives by avoiding traditional banking fees, saving automatically, and improving their credit.

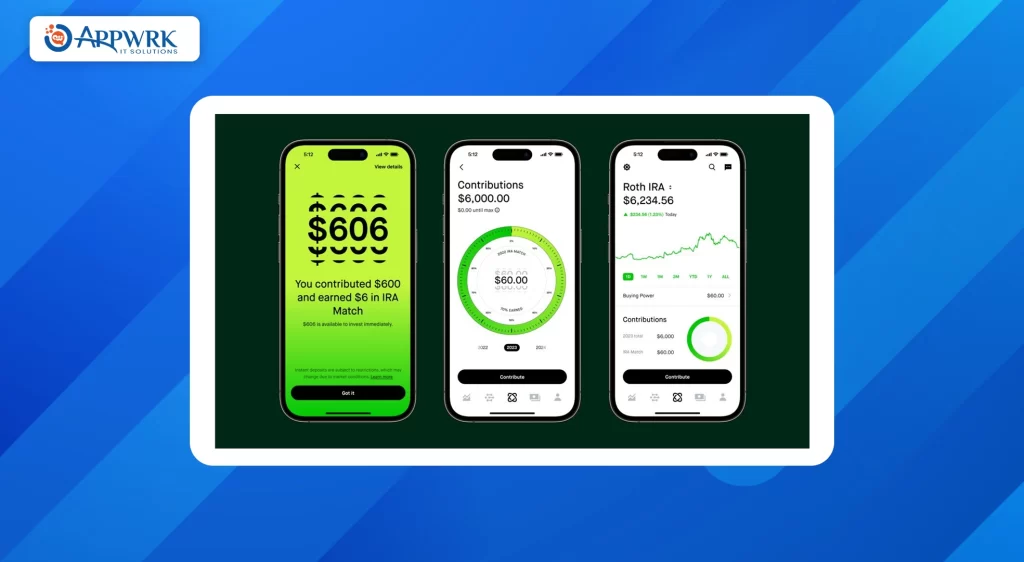

Robinhood

Robinhood (Android, iOS) is a commission-free investing platform popular for its intuitive and user-friendly mobile app. It offers users the ability to buy and sell stocks, ETFs, options, and cryptocurrencies without charging any commission fees. Robinhood’s mission is to democratize finance for all by making investing more accessible to the general public, not just the wealthy people.

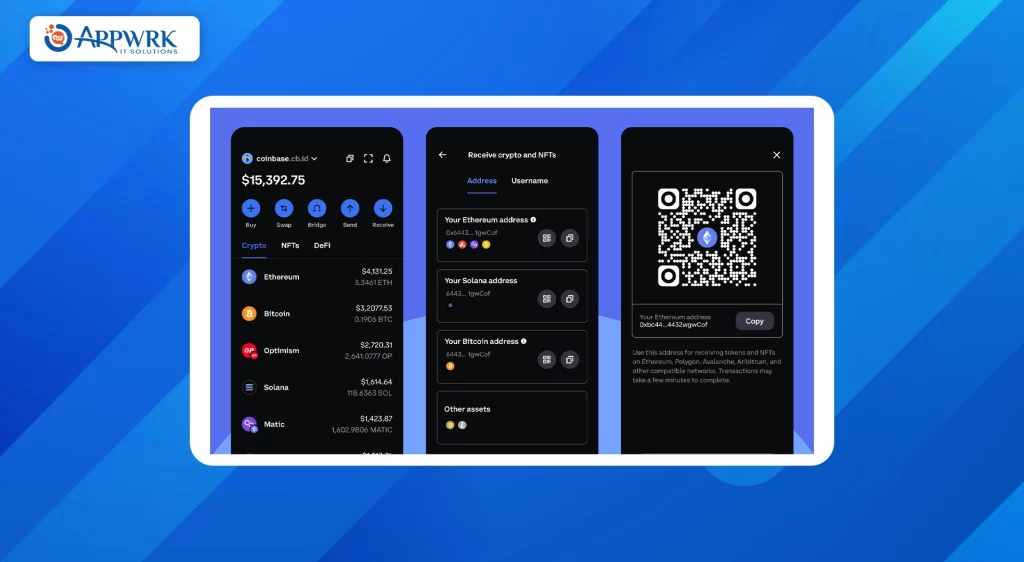

Coinbase

Coinbase (Android, iOS) is a leading cryptocurrency exchange platform where users can buy, sell, and store a wide variety of digital currencies like Bitcoin, Ethereum, and more. Beyond trading, Coinbase also offers educational resources for users to learn about cryptocurrencies and blockchain technology. Coinbase’s goal is to create an open financial system for the world and to be the leading global brand for helping people convert digital currency into and out of their local currency.

Various Types Of Fintech Apps To Choose From

Insurance Mobile Apps

Insurance apps are revolutionizing the insurance industry by providing a streamlined, customer-centric approach. These apps allow users to purchase insurance policies, manage their policies, file claims, and even get roadside assistance with just a few taps on their smartphones. Advanced features might include AI-driven personalized policy recommendations and chatbots for instant support. By reducing paperwork and providing transparency throughout the claim process, these apps are redefining the traditional insurance landscape. Moreover, they are expanding their capabilities to meet diverse business needs like liability insurance, cyber insurance, and employee coverage insurance, thus transforming the way businesses secure and manage their insurance portfolios.

Investment Mobile Apps

Investment apps democratize investment by providing easy access to different types of investment vehicles, including stocks, bonds, ETFs, mutual funds, and cryptocurrencies. Users can manage their portfolios on the go, get real-time updates on market trends, and make informed decisions with the help of integrated research and analytics tools. Some investment apps also offer robo-advisor services that automatically create and manage a diversified portfolio based on the user’s risk tolerance and investment goals.

Banking & Money Management Mobile Apps

Banking and money management mobile apps are essentially digital banks in your pocket. They allow users to do everything from making payments, transferring money, depositing cheques via photo, and even applying for loans or credit cards. They provide instant notifications for all transactions, which aids in better money management. Additionally, many of these apps offer budgeting tools and insights into spending habits, helping users better manage their finances.

Regtech Apps

Regulatory technology (Regtech) apps help companies navigate the complex world of financial regulations. They use technologies like artificial intelligence and big data to automate compliance tasks, detect regulatory changes, assess risks, and report in real time. By minimizing manual intervention, these apps significantly reduce compliance costs and mitigate risks associated with regulatory non-compliance. They are a critical tool for financial institutions in the current fast-changing regulatory environment.

Money Lending Mobile Apps

Lending apps aim to simplify the borrowing process by providing quick and easy loans. They use data-driven algorithms to assess creditworthiness, thus eliminating the need for lengthy paperwork. Some apps also offer peer-to-peer lending, connecting borrowers directly with individual lenders. These apps are playing a pivotal role in increasing financial inclusion by offering loans to individuals and businesses who might otherwise struggle to access traditional forms of credit.

Personal Finance Mobile Apps

Personal apps are a one-stop solution for managing personal finances. They help users keep track of all their financial accounts, expenses, and investments in one place. They also offer personalized advice to improve financial health, such as identifying unnecessary expenses, offering tips to improve credit scores, and suggesting investment strategies. Some apps also provide financial literacy resources to educate users about various financial concepts.

Budgeting Apps

These apps help users create and manage their budgets effectively. Users can set spending limits for different categories, track their income and expenses, and get a visual representation of their spending patterns. Some apps also provide bill reminders to avoid late fees and offer tips to save money. By providing a clear picture of their finances, these apps help users control their spending and save more effectively.

Accounting Apps

These apps streamline accounting tasks for businesses and freelancers. They allow users to track income and expenses, send invoices and receipts, process payroll, and generate various financial reports. They also simplify tax filing by automatically categorizing transactions and calculating the tax liability. By automating repetitive tasks, these apps save time and reduce the chances of errors, allowing business owners to focus more on their core business.

Reasons To Develop A Fintech App

Financial Literacy

Fintech apps play a critical role in promoting financial literacy. They offer tools that help users understand financial concepts, manage their money effectively, and make informed financial decisions. From budgeting to investing to debt management, fintech apps empower users with knowledge and tools, making financial literacy more accessible.

By creating a fintech app that promotes financial literacy, businesses can build trust and loyalty among users. When businesses equip their customers with knowledge and tools to better manage their finances, they are seen as more than just service providers; they become partners in their users’ financial journey. This engagement fosters a positive brand image and encourages user retention.

Increased Mobile Usage

With the widespread adoption of smartphones, more people are using mobile apps for their daily activities, including financial tasks. Fintech apps cater to this trend by providing a convenient way for users to manage their finances from their mobile devices. This surge in mobile usage opens up a vast market for businesses.

With a fintech app, businesses can reach customers directly on their smartphones, offering services right at their fingertips. This not only provides convenience to users but also allows businesses to collect valuable user data, offer personalized services, and drive revenue growth. Therefore, by developing a fintech app, you can tap into this growing market and meet user demands for mobile financial services.

Digital Transformation

The financial industry is undergoing a significant digital transformation, with traditional financial institutions facing stiff competition from digital-only banks and other fintech services. Developing Custom Fintech App Development Solutions will allow you to participate in this digital revolution and offer a modern, digital-first approach to financial services. Furthermore, digital operations often bring cost-efficiency, enabling businesses to streamline their services and maximize profitability. It’s a way to stay competitive in an increasingly digital financial landscape.

How Do Fintech Applications Make Money Online

- Subscription Model: Under this model, fintech apps charge users a recurring fee, usually monthly or annually, for access to their service. The subscription model provides a consistent revenue stream and helps retain customers over the long term.

- Freemium Model: In the freemium model, basic services are offered for free, but users have to pay for advanced features or premium services. This model can attract a large user base by offering valuable services for free, and a portion of these users might upgrade to the premium version for additional features.

- Transaction Fees: Many fintech apps, especially those in the payment, trading, or lending sectors, earn money through transaction fees. These apps may charge a small percentage of the transaction value each time money is sent or received.

- Advertising: Like many other online platforms, fintech apps can generate revenue through advertising. They can display ads from third parties within the app or promote financial products and services from partner companies.

- Referral Programs: Fintech apps often have referral programs where they reward users for bringing in new users. This could be a cash reward, a discount, or some other incentive. At the same time, the company benefits from acquiring new customers at a relatively low cost.

- Data Monetization: Given the amount of financial data that fintech apps collect, some companies monetize this data by providing insights to third-party companies. These insights can help other businesses understand market trends, consumer behavior, and other valuable information. However, it’s important to note that any data sharing must be done in compliance with data privacy regulations and with the consent of the users.

Top Fintech App Development Trends In 2023

1. Integration With Blockchain Technology

Blockchain technology is being increasingly adopted in fintech app development. It offers high-level security, transparency, and traceability, which are invaluable in financial transactions. From smart contracts to secure payment processing to fraud prevention, blockchain integration is changing the face of fintech in 2023.

2. Personalization And AI-Driven Features

Fintech apps are leaning heavily into AI to provide personalized experiences to users. By analyzing user behavior, preferences, and financial goals, AI-driven fintech apps can offer custom financial advice, product recommendations, and more. AI chatbots are also becoming increasingly sophisticated, delivering instant customer support and guidance.

3. Expansion Of Open Banking

Open banking allows third-party developers to create new financial products and services using consumer banking data. It’s set to expand significantly in the coming years, with more and more fintech mobile apps using this technology to offer innovative services like seamless money transfers, financial management tools, and personalized financial advice.

4. Increased Use Of Biometrics

Biometric authentication, such as fingerprint and face recognition, is being adopted widely for enhanced security. It offers a highly secure way to authenticate user identities and protect against fraud.

5. Growth Of Decentralized Finance (DeFi)

DeFi applications are aiming to replace traditional financial intermediaries with blockchain-based protocols. They offer services like lending, borrowing, trading, and investment without the need for a central authority.

6. Focus On Sustainability

As environmental concerns continue to take center stage, fintech apps are also focusing on sustainability. For instance, green fintech applications are emerging to support sustainable investing and carbon footprint tracking. This trend is set to grow in the years ahead as users increasingly seek ways to align their financial activities with their environmental values.

7. Expansion Of Neo-banks

Neo-banks, or digital-only banks, offer all their services online or via mobile apps. They are gaining popularity due to their convenience, user-friendly interfaces, and competitive offerings.

Features To Include In Your Finance App

General Features

1. Registration

The registration feature allows new users to create an account on your fintech app. The registration process should be easy and user-friendly so that users can sign up and log in through email ids, passwords, and phone numbers. Also, you can include a multi-factor authentication process to ensure safety and privacy.

2. Personal Account

A personal account feature gives each user a dedicated space to manage their finances. It displays an overview of the user’s financial status, including account balance, recent transactions, and financial goals. Personalization options can enhance user engagement, such as setting profile pictures or choosing theme colors.

3. Payment Gateway

The payment gateway feature should provide a secure, smooth, and quick transaction process to ensure a good user experience. Your fintech app should support different payment methods like bank transfers, credit/debit cards, and digital wallets.

4. Financial Management

The financial management feature is at the heart of any finance app. This feature offers plenty of services to the users, like expense tracking, budgeting, investment tracking, and financial goal setting. You can also incorporate visualization tools, such as charts and graphs, to make financial data easy to understand.

5. Connecting Or Creating Bank Cards

This feature allows users to connect their existing bank cards to the app for seamless transactions. You can offer the option for users to create new virtual bank cards within your fintech app. Other than this, users can also view, manage, and update their cards conveniently through this feature.

6. Notification

Notification is another important fintech app feature as it keeps users informed about significant activities in their accounts. These can include payment due dates, unusual transactions, account balance updates, and the achievement of financial goals. Push notifications can engage users in real-time and encourage them to take necessary actions promptly.

7. History Of Transactions And Interactions

You can provide a transaction history option in your fintech app where users can track their spending from time to time and understand their financial patterns. This feature can include search and filter options for easy access to specific transaction details.

8. Onboarding System

An onboarding system guides new users through the app’s features and functionalities. Therefore, the onboarding system should be intuitive and interactive, ensuring users understand how to use the app effectively right from the start.

9. Chatbots

Another essential feature is the chatbots that provide automated customer support. They can answer frequently asked questions, guide users through certain processes, and provide basic financial advice. They’re available 24/7, improving the app’s customer service and enhancing user engagement.

Advanced Features

1. Biometric Scanning

Biometric scanning enhances the security level of your fintech app. It allows users to log in or authorize transactions using their fingerprints or face recognition. This feature not only provides a secure authentication method but also offers a smooth and quick login experience for users.

2. Two-factor Authentication

Two-factor authentication is another crucial security feature. In addition to the usual login credentials, a second level of user verification is required, such as a code sent to the user’s mobile number or email. This feature makes it difficult for unauthorized users to gain access to the account, even if they have login credentials.

3. KYC

KYC, or Know Your Customer, is a process by which fintech apps verify the identity of their users. It often involves providing a government-issued ID and a selfie. KYC is crucial for preventing fraud, money laundering, and other illegal activities, and it’s a regulatory requirement in many jurisdictions.

4. Cashback

The cashback feature offers users a percentage of their spending back as a reward. It encourages users to transact through the app and can significantly enhance customer loyalty. The cashback can be in the form of money added to the app wallet, points that can be redeemed for certain services, or discounts on future transactions.

5. Card Scanning

Card scanning simplifies the process of adding a new credit or debit card to the app. By using the phone’s camera, the app can capture the card’s details instead of the user having to enter them manually. This feature enhances the user experience by making it easy and quick to add a card.

6. Cost Tracking

Cost tracking is a vital feature for helping users manage their finances effectively. It automatically categorizes expenses and tracks them against the user’s set budget. Visualization of this data can help users see their spending patterns and identify areas where they can save money.

7. Referral System

A referral system encourages users to invite their friends or family to use the app. In return, both the referrer and the referred user receive rewards. This feature can significantly boost the user base of the app while also enhancing customer engagement and loyalty.

Key FinTech App Development Requirements

Security

Given the sensitive financial data handled by fintech apps, security is the topmost requirement. It’s vital to protect user data from cyber threats and ensure secure transactions. This involves incorporating encryption techniques, secure servers, biometric authentication, two-factor authentication, and other security protocols. Regular security audits and compliance with industry regulations like PCI DSS (Payment Card Industry Data Security Standard) are also crucial.

Integrations

To provide a seamless user experience, fintech apps need to integrate with various other systems. This includes payment gateways for processing transactions, banking APIs for account data and transactions, third-party services for functionalities like credit scoring or identity verification, and more. Ensuring these integrations work smoothly and securely is a key requirement.

Simplicity

The user interface and experience should be simple and intuitive. Users should be able to navigate the app easily, understand its features, and perform transactions without confusion. This requires a clean design, clear instructions, helpful prompts, and an intuitive flow. Simplicity also extends to processes like registration and account setup – the easier these are, the more likely users are to start and continue using the app.

Support

Effective customer support is essential for fintech apps. Users should be able to get quick and accurate answers to their queries, whether they’re related to app functionality, transactions, or security issues. This might involve a combination of AI-driven chatbots for instant support and human assistance for more complex queries. Having an efficient support system in place not only resolves user issues but also builds trust, which is particularly important in the financial domain.

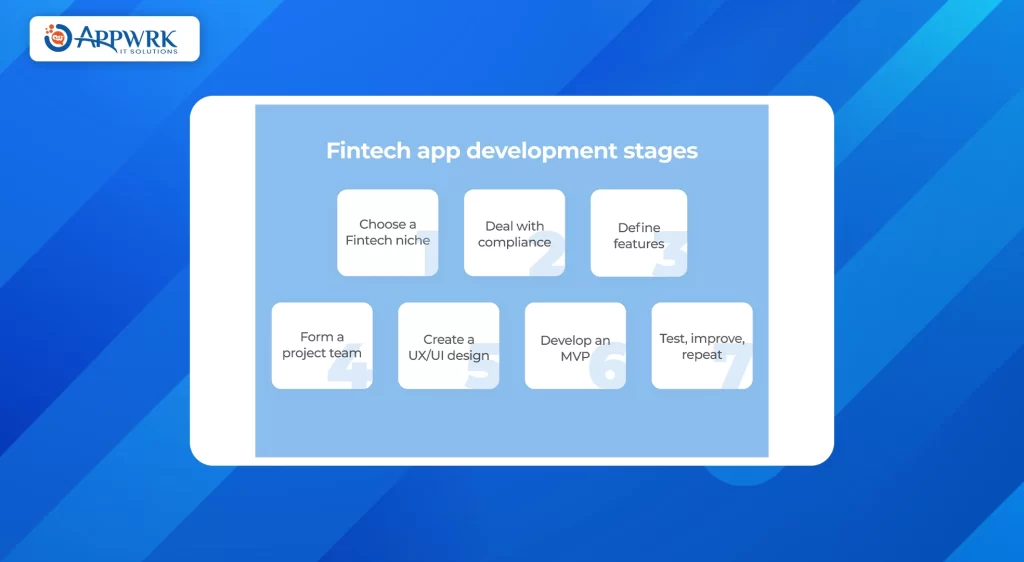

Various Stages In Fintech Application Development

Stage I: Choose Your Fintech Niche

The first step in developing a fintech application is to choose your niche within the vast field of financial technology. You need to decide whether you want to make a fresh start with your fintech solution or improvise an existing one. Whether you’re targeting personal finance, investment, payments, lending, or any other area, it’s important to understand your target market and its needs. Custom mobile app consultants can provide invaluable insights and guidance throughout this process, helping you tailor your fintech solution to meet the specific needs of your target audience. Also, you need to legalize the app after you have chosen your niche.

Stage II: Deal With Compliance

The financial sector is heavily regulated, and fintech apps need to comply with relevant regulations. This can include data protection laws, anti-money laundering rules, and specific financial regulations. Engage with legal experts to ensure your app idea is compliant with the privacy laws (CCPA, GDPR, LGPD, PIA) from the start.

Stage III: Define Your Features

Based on your target market and unique value proposition, define the key features of your fintech app. Consider both basic features (such as account management and transactions) and advanced features (like AI-driven financial advice or biometric authentication) to offer a competitive product.

Stage IV: Get A Team Or Hire A Software Service Provider

You’ll need a team of skilled professionals to develop your app. This can include roles like project manager, UX/UI designer, developer, and quality assurance expert. Depending on your resources and expertise, you can hire a fintech mobile app development company that understands your business needs and provides you with exceptional fintech app development services at the most affordable prices.

Stage V: Create A Compelling UX/UI Design

The user experience (UX) and user interface (UI) design are crucial aspects of your fintech mobile app. The UX should be intuitive and user-friendly, and the fintech app UI should be visually appealing. Engage with UX/UI experts to ensure your fintech app design meets user needs and expectations.

Stage VI: Develop An MVP

A Minimum Viable Product (MVP) is a version of your app with just the essential features. Developing an MVP allows you to test your app idea in the market without investing too much time and resources. It can also help you attract early users and gain valuable feedback.

Stage VII: Test, Improve, Repeat

Once your MVP is developed, conduct thorough testing to identify and fix any bugs. Gather feedback from early users to understand what works and what doesn’t. Based on these insights, make necessary improvements and keep iterating your product. This process of continuous improvement is essential to keep your app relevant and competitive in the fast-paced fintech sector.

Technology Stack Used In A Fintech Application

You’ll need to choose the right tech stack to build a robust and reliable app. Your tech stack depends on factors like target audience, application goals, industry-specific requirements, and third-party integrations.

Consider these technologies for your custom fintech app development:

| Programming languages | Java or Kotlin for Android, Swift or Objective-C for iOS |

| Frontend | HTML, CSS, JavaScript |

| Backend | Python, C++, Ruby |

| Frameworks | Ruby on Rails, Django, Spring |

| Database | PostgreSQL, MySQL, MongoDB |

| Cloud environment | AWS, Google, Azure |

| Payment Gateway | Braintree, Stripe, Paypal |

How Much Does It Cost To Build A Fintech App

Developing an app needs detailed information about various factors and aspects to reach an estimated particular cost structure. There are many factors due to which the cost of developing your app may vary. However, there are fundamentally three factors on which fintech app development cost depends:

- App complexity: The cost of fintech mobile app development depends on the level of complexity you need, for instance, additional features, designs, customizations, and third-party integrations.

- Location: Fintech app development cost varies from place to place. Different locations have different hourly charges for the development team.

- App platform: The cost of developing an app for Android or iOS platforms varies. It also depends on the development approach you choose, whether native or cross-platform.

- Post-development cost: Apart from this, you should also consider other post-development costs that include app maintenance and support costs, as well as marketing and promotion costs.

Based on the above factors, it must be clear that fintech application development requires proper cost estimations. If you want fintech app development services from India, the cost may start from $999. APPWRK IT Solutions, a leading fintech app development company, has a proven track record of building successful mobile apps for clients worldwide, including those in the US, with the price starting from just $999! Contact us today for further assistance.

APPWRK IT Solutions – Multiply Your Profits With Our Robust Fintech Development Services

In the rapidly evolving world, the need for fintech app development has skyrocketed. However, to scale the heights in this competitive market, you need to hire an experienced financial app development company that leverages the latest technologies to develop high-performance fintech applications. APPWRK is here to provide you with a seasoned team of fintech app developers that will build an app with user-friendly and intuitive designs with a blend of financial expertise.

APPWRK IT Solutions is a mobile app development company and a trusted partner in your long-term growth and progress journey. Our expert mobile designers and developers have completed over 2000 projects globally that have helped businesses scale up development, design, and digital marketing proficiency. We understand that every business is unique. Hence, we assure you to provide custom fintech app development solutions that are interactive, secure, and user-friendly.

Conclusion

The dynamic world of fintech app development is rapidly evolving, providing businesses with an extraordinary opportunity to disrupt traditional financial systems and redefine how consumers interact with financial services. The confluence of advanced technologies, customer expectations for convenience, and an increasingly mobile-first approach makes fintech apps more relevant than ever. By embracing fintech app development, you can certainly enter the massive market of tech-savvy consumers seeking personalized, seamless, and instant financial services.

Today, with this transformation in the digital age, the significance of fintech apps will only grow. With their potential to democratize access to financial services, improve financial literacy, and foster financial inclusion, fintech apps stand at the forefront of the future of finance. Undoubtedly, fintech app development represents an investment not only in your digital transformation journey but also in sustained revenue growth and market competitiveness.

So, get ready to ride this wave with us! Contact us to develop an exclusive app from the best fintech app developers in the industry!

FAQs

Fintech broadly covers four main areas: Payments and Transfers (digital wallets, peer-to-peer payment apps), Personal Finance (budgeting apps, robo-advisors), Lending and Funding (peer-to-peer lending, crowdfunding platforms), and Insurtech (digital insurance platforms).

Fintech development involves creating applications that automate and enhance financial services. Examples include investing apps like Robinhood, personal finance apps like MoneyLion, and digital-only banks like Chime.

Fintech apps work by leveraging technology to provide various financial services. They connect to users’ financial accounts, gather data, and then use this data to provide services like budget tracking, investment advice, or streamlined payments. The exact functions depend on the type of fintech app.

Fintech app development allows businesses to offer modern, customer-centric financial services. It can expand the customer base, improve customer experience, streamline operations, and open up new revenue streams. In addition, fintech apps provide valuable data insights, enabling personalized services and better decision-making.

According to the latest reports, the fintech industry is projected to grow to $324 billion at a compound annual growth rate (CAGR) of 25.18% by 2026.

The most popular fintech apps in the USA include personal finance apps like MoneyLion, investment platforms like Robinhood, and digital banks like Chime. However, the most used can vary depending on specific criteria like user base, transaction volume, or user engagement.

About The Author